| MVB Financial Corp. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box):

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | ||||

Fee computed on table below per Exchange Act Rules 14a-6(i) | ||||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | ||||

Fee paid previously with preliminary materials. | ||||

o | ||||

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

MVB FINANCIAL CORP.

301 VIRGINIA AVENUE

FAIRMONT, WEST VIRGINIA 26554-2777

(304) 363-4800

NOTICE OF ANNUALSPECIAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 21, 2013FEBRUARY 11, 2014

To the Shareholders:

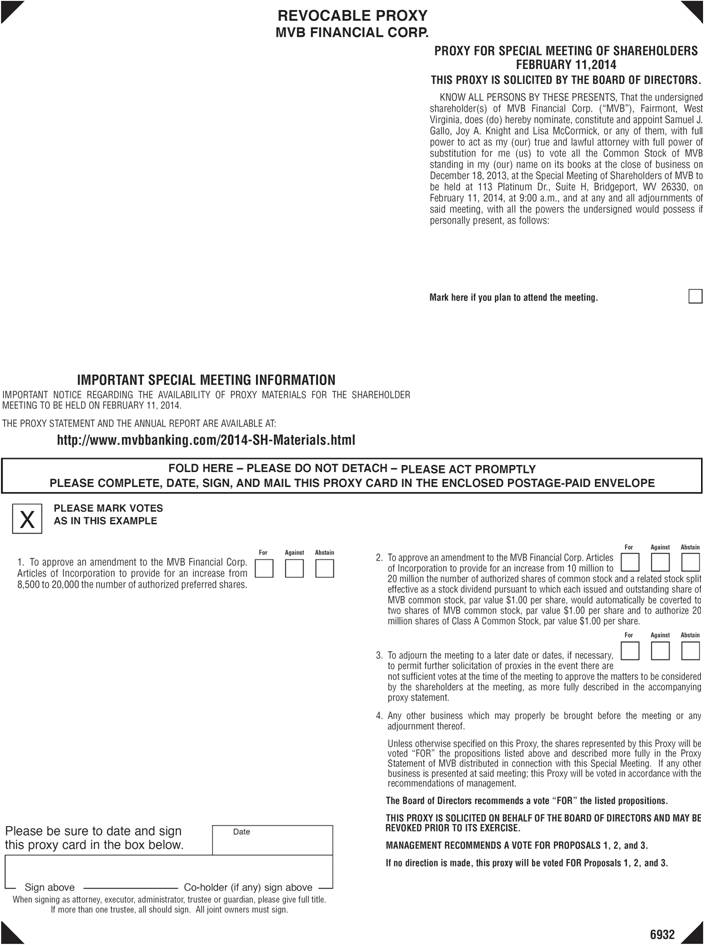

The AnnualSpecial Meeting of Shareholders of MVB Financial Corp. (“MVB”("MVB") will be held at 4035 Ridge Top Road, Fairfax, Virginia and at 113 Platinum Drive, Suite H, Bridgeport, West Virginia, (MVB’s new Operations Center), at 5:30 p.m.9:00 a.m. on May 21, 2013. You may attend at either location. Video communications will link the two sites. This meeting isFebruary 11, 2014 for the purposes of considering and voting upon proposals:

- 1.

- To approve an amendment to the MVB Financial Corp. Articles of Incorporation to provide for an increase from 8,500 to 20,000 the number of authorized preferred shares;

- 2.

- To approve an amendment to the MVB Financial Corp. Articles of Incorporation to provide for an increase from 10 million to 20 million the number of authorized shares of common stock and a related stock split effected as a stock dividend pursuant to which each issued and outstanding share of MVB common stock, par value $1.00 per share, would automatically be converted to two shares of MVB common stock, par value $1.00 per share and to authorize 20 million shares of Class A Common Stock, par value $1.00 per share;

- 3.

- To adjourn the meeting to a later date or dates, if necessary, to permit further solicitation of proxies in the event there are not sufficient votes at the time of the meeting to approve the matters to be considered by the shareholders at the meeting, as more fully described in the accompanying proxy statement; and

- 4.

- To transact any other business that may properly be brought before the meeting or any adjournment thereof. We are not aware of any such matters at this time.

Only those shareholders of record at the close of business on April 1,December 18, 2013, shall be entitled to notice of the meeting and to vote at the meeting. The approximate date on which this Proxy Statement and form

By Order of proxy are first sent or given to security holders is April 11, 2013.the Board of Directors,

Larry F. Mazza

Chief Executive Officer

Please sign and return the enclosed proxy in the enclosed self-addressed, postage-paid envelope as promptly as possible, whether or not you plan to attend the meeting in person. If you do attend the meeting, you may votehave the option to withdraw your shares in person, even though you have previously signed and returned your proxy.proxy before it is voted.

January 2, 2014

April 11, 2013

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUALSPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 21, 2013—FEBRUARY 11, 2014—THE NOTICE OF MEETING, THE PROXY STATEMENT, AND THE PROXY CARD AND THE ANNUAL REPORT FOR THE YEAR ENDED DECEMBER 31, 2012, INCLUDED HEREIN, ARE ALSO AVAILABLE AThttp://www.mvbbanking.com/2013-SH-Materials.html2014-SH-Materials.htmlDIRECTIONS TO THE ANNUAL MEETING WHERE YOU MAY VOTE IN PERSON CAN BE FOUND ONhttp://www.mvbbanking.com/2013-SH-Materials.html.2014-SH-Materials.html.

[INTENTIONALLY LEFT BLANK]

MVB FINANCIAL CORP.

301 VIRGINIA AVENUE

FAIRMONT, WEST VIRGINIA 26554-2777

(304) 363-4800

ANNUAL

SPECIAL MEETING OF SHAREHOLDERS

May 21, 2013SHAREHOLDERS—FEBRUARY 11, 2014

ThisMVB Financial Corp. ("MVB" or the "Company") is furnishing this statement is furnished in connection with theits solicitation of proxies for use at the Annuala Special Meeting of Shareholders of MVB Financial Corp. (“MVB”, or the “Company”) to be held on May 21, 2013,February 11, 2014, at the time and for the purposes set forth in the accompanying Notice of AnnualSpecial Meeting of Shareholders.

Solicitation of Proxies

The solicitationMVB's management, at the direction of proxiesMVB's board of directors, is made by the Board of Directors of MVB.making this proxy solicitation. These proxies enable shareholders to vote on all matters that are scheduled to come before the meeting. If the enclosed proxy is signed and returned, it will be voted as directed; or if not directed, the proxy will be voted “FOR”"FOR" all of the various proposals to be submitted to the vote of shareholders described in the enclosed Notice of AnnualSpecial Meeting and this Proxy Statement. Other than the matters listed in the Notice of Annual Meeting of Shareholders, the Board knows of no additional matters that will be presented for consideration at the Annual Meeting.

proxy statement. A shareholder executing the proxy may revoke it at any time before it is voted:voted by:

- •

- notifying MVB representatives Stephen R. Brooks, Larry F. Mazza or Lisa McCormick in person;

- •

- giving written notice to MVB of the revocation of the proxy. The revocation should be delivered to Lisa J. McCormick, Corporate Secretary, 301 Virginia Avenue, Fairmont, West Virginia 26554-2777;

- •

- submitting to MVB a subsequently-dated proxy; or

- •

- attending the meeting and withdrawing the proxy before it is voted at the meeting.

The expenses of the solicitation of proxies will be paid by MVB.this proxy solicitation. In addition to this solicitation by mail, directors, officers and regular employees of MVB orand its subsidiary, subsidiaries—MVB Bank, Inc. (the “Bank”("MVB Bank"), Potomac Mortgage Group, Inc., which does business as MVB Mortgage ("MVB Mortgage"), and MVB Insurance, LLC ("MVB Insurance")—may, to a limited extent, solicit proxies personally or by telephone or telegraph, although no person will be engaged specifically engaged for that purpose.

Eligibility of Stock for Voting Purposes

Pursuant toUnder MVB's Bylaws, the Bylawsboard of MVB, the Board of Directorsdirectors has fixed April 1,December 18, 2013, as the record date for the purpose of determining the shareholders entitled to notice of, and to vote at, the meeting or any adjournment thereof, and onlythereof. Only shareholders of record at the close of business on that date are entitled to such notice of and to vote at such meetingthe Special Meeting or any adjournment thereof. The presence, in person, or by properly executed proxy, of the holders of a majority of the outstanding shares of the Company's common stock entitled to vote at the Special Meeting is necessary to constitute a quorum at the Special Meeting. Abstentions will be counted as shares present for purposes of determining the presence of a quorum. Any shares held in street name that are not voted ("broker non-votes") in the proposal to amend the Articles of Incorporation will not be included in determining the number of votes.

As of the record date for the AnnualSpecial Meeting, approximately 3,451,5823,759,050 shares of the common stock of MVB owned by approximately 1,140 shareholders, were issued and outstanding and entitled to vote. ThereIn addition, 8,500 shares of preferred stock are 4,000,000 shares authorized.issued and outstanding. MVB is in the process of determining whether the United States Treasury is entitled to vote on Proposal 1. If the Treasury is entitled to vote on Proposal 1 and votes against the proposal,

then Proposal 1 will not be adopted. The principal holders of MVB Common Stockcommon stock are discussed under the section of this Proxy Statementproxy statement entitled, “Principal"Principal Holders of Voting Securities.”Securities". As of the record date, MVB had a total of approximately 1,200 shareholders of record.

PURPOSE OF MEETING

1. Proposals to Amend MVB's Articles of Incorporation

General

PURPOSES OF MEETING

General

The BylawsUnder the proposals, the initial portion of MVB currently provide for a BoardArticle V of Directors composedthe Company's Articles of five Incorporation would be amended:

- 1.

- to

twenty five membersincrease from 8,500 tobe elected annually. The Board has set 16 as20,000 the number ofdirectorsauthorized shares of the preferred stock of the Company; - 2.

- to authorize an increase in the number of authorized shares of common stock from 10 million (10,000,000) to 20 million (20,000,000) shares and a related stock split effected as a stock dividend, with each issued and outstanding share of MVB

forcommon stock, $1.00 par value per share, being automatically converted into two shares of MVB common stock, $1.00 par value per share, and to authorize 20 million (20,000,000) shares of Class A Common Stock, par value $1.00 per share. If theupcoming year. Thisamendment is2 less members than was proposed in 2012. This decrease isauthorized, the Company would issue certificates or initiate book entries representing the additional shares as a result ofseveral director retirements andthe stock split effected as afewer number of director nominees selectedstock dividend. The new certificates would be delivered toreplace them.Directors are elected by a pluralitythe shareholders of thevotes cast. Therefore, a vote withheld will not affectCompany at theoutcomeeffective time of theelection. As required by West Virginia law,stock split.

Assuming all proposals are adopted, the first paragraph of Article V would read as follows:

ARTICLE V

The amount of the total authorized capital stock of said corporation shall be sixty million dollars ($60,000,000), which shall be divided into twenty million (20,000,000) shares of Common Stock with a value of $1.00 each per share, is entitledtwenty million (20,000,000) shares of Class A Common Stock, par value $1.00 per share ("Class A Common Stock"); and twenty thousand (20,000) shares of Preferred Stock with a par value of $1,000 per share ("Preferred Stock").

At the end of Article V, the following provisions would be added:

- (i)

- the rate of dividends;

Class A Common Stock shall be ranked junior to one vote per nominee, unless a shareholder requests cumulative voting for directors at least 48 hours before the meeting. If a shareholder properly requests cumulative voting for directors, then each MVB shareholder will have the right to vote the number of shares owned by that shareholder for as many persons as there are directors to be elected, or to cumulate such sharesany Preferred Stock issued and give one candidate as many votes as the number of directors multiplied by the number of shares owned shall equal, or to distribute them on the same principle among as many candidates as the shareholder sees fit. If any shares are voted cumulatively for the election of directors, the proxies, unless otherwise directed, shall have full discretion and authority to cumulate their votes and vote for less than all such nominees. For all other purposes, each share is entitled to one vote.

Management Nomineesoutstanding, with respect to the Boardpayment of MVBdividends and the distribution of assets in the event of any dissolution, liquidation or winding up of the Corporation. The voting powers, designations, preferences, limitations, restrictions and relative rights of the Class A Common Stock are as follows:

The A. Issuance in Series. Class A Common Stock may be issued from time to time in one or more series. All shares of Class A Common Stock shall be of equal rank and shall be identical, except in respect of the particulars that are fixed in the Articles of Incorporation provide for staggered terms for directors. Approximately one-third of the Directors are elected to a three-year term each year. The eight individuals identified below represent management nominees to the Board of Directors. Five willor may be elected for a three-year term, one will be elected for a one-year term and two will be elected for a two-year term. Following the election of the eight nominees, MVB will have three classes of directors. Two of the classes of directors will consist of five board members while the third class will include six board members. The term of office of the eight directors is indicated herein.

Directors | Age as of April 1, 2013 | Director and/or Officer Since | Term Expires | Principal Occupation During the Last Five Years | ||||

| David B. Alvarez | 49 | * | 2015 | President of MEC Construction, LLC | ||||

| James J. Cava, Jr. | 48 | * | 2014 | Managing Member – Cava & Banko, PLLC, Certified Public Accountants | ||||

| John W. Ebert | 53 | * | 2015 | President J.W. Ebert Corporation, a McDonald’s Restaurant franchisee | ||||

| H. Edward Dean, III | 44 | 2012 | 2016 | December 2012 to present, President & CEO Potomac Mortgage Group, Inc., a wholly owned subsidiary of MVB Bank, Inc. July 2009 to December 2012, President & CEO Potomac Mortgage Group, Inc. July 2004 to June 2009 President & CEO Mason Mortgage, LLC. |

Directors | Age as of April 1, 2013 | Director and/or Officer Since | Term Expires | Principal Occupation During the Last Five Years | ||||

| James R. Martin | 65 | 1999 | 2016 | May 19, 2009-Chairman of Board and Director of MVB and Bank; January 1, 2009 to May 10, 2009 Vice Chairman of the Board and Director of MVB and Bank; previously President, CEO and Director of MVB and Bank | ||||

| J. Christopher Pallotta | 63 | 1999 | 2016 | President-Bond Insurance Agency | ||||

| Roger J. Turner | 62 | 2005 | 2016 | President-MVB; Executive Vice President, Commercial Lending, Bank | ||||

| Samuel J. Warash | 63 | 1999 | 2016 | President- S.J. Warash, Inc. (real estate appraisal company) |

* 2013 nominee; currently serves as member of MVB-Central, Inc. Board of Directors

Director Nominee Business Experience

David B. Alvarez - President of MEC Construction, LLC, a division of Shaft Drillers International. He has been involved in the construction business throughout the North Eastern United States natural gas fields for more than 20 years. Alvarez has founded numerous successful businesses in North Central West Virginia. He is a graduate of West Virginia University with a B.S. in Business Administration. He is extremely involved in various professional, educational and philanthropic activities throughout West Virginia, including serving as a member of the Board of Governors of West Virginia University. Mr. Alvarez was nominated because of his knowledge of the West Virginia markets, his knowledge of the construction industry and his community involvement.

James J. Cava, Jr. – Managing Member – Cava & Banko, PLLC, Certified Public Accountants. Mr. Cava has been involved in the West Virginia business community for over 25 years. He is very knowledgeable about the economic activities in the MVB market area. Mr. Cava has founded several successful business organizations. He is a graduate of Fairmont State University with a B.S. in Business Administration and American University with a Master’s degree in Taxation. Mr. Cava was nominated because of his knowledge of the West Virginia business community and his investment, financial and accounting expertise.

H. Edward Dean, III - President & CEO Potomac Mortgage Group, Inc., a wholly owned subsidiary of MVB Bank, Inc. He has been involved in the residential real estate mortgage business since 1996 in the northern Virginia market area. Mr. Dean is very familiar with the entire mortgage loan process from origination, to implementing of operational processes to supervising the entire process. Mr. Dean was nominated because of his extensive knowledge of the mortgage loan process and his position as President and CEO of Potomac Mortgage Group, Inc. He is a 1991 graduate of West Virginia University with a B.S. in Accounting.

John W. Ebert –President of J.W. Ebert Corporation which owns 16 McDonald’s franchises in West Virginia and Maryland. He has over 20 years of retail experience. He is the Chairman of McDonald’s East Division Profit Team representing 5,000 restaurants. He is the former President of the Pittsburgh Region’s McDonald’s Owner/Operator Association. Mr. Ebert is a 1982 graduate of the University of Notre Dame with a B.S. in Accounting and began his career as a Certified Public Accountant for a national accounting firm. Mr. Ebert was nominated because of his knowledge of the North Central West Virginia market, his educational background and business expertise.

James R. Martin – Chair – MVB Financial Corp., MVB organizer, director and original CEO for 11 years. He has 38 years of experience in the banking industry in MVB’s North Central West Virginia market area. He began his career as a Certified Public Accountant at a national accounting firm specializing in audits of financial institutions. He is a graduate of University of Kentucky with a B.S. in Accounting. We have nominated Mr. Martin because of his extensive experience and expertise in managing financial institutions and his extensive knowledge of MVB’s operations.

J. Christopher Pallotta – President – Bond Insurance Agency, MVB organizer and director. He has been involved in the insurance and related securities business in North Central West Virginia market area for 38 years. He is also the owner of other small businesses in the MVB market area. He is a life-long resident of North Central West Virginia and is active in community organizations. He is a graduate of Fairmont State University with a B.S. in Business Administration. Mr. Pallotta was nominated because, as a founding director of MVB, he has extensive knowledge of MVB and its operations, because of his knowledge of the market in North Central West Virginia and because of his experience and expertise in the areas of insurance and securities.

Roger J. Turner - MVB Director. He is President of MVB, Executive Vice President and Senior Commercial Lending Officer of MVB Bank, Inc. Mr. Turner has been involved in commercial lending throughout West Virginia for over 30 years. He is a graduate of Glenville State College with degrees in Marketing and Management. Mr. Turner was nominated due to his extremely valuable service to MVB Bank, Inc. and his knowledge of high quality commercial borrowers in West Virginia.

Samuel J. Warash – MVB organizer and Director. He is the founder and owner of S.J. Warash Co., Inc., a real estate appraisal consulting firm, for 36 years. His commercial and residential real estate appraisal services cover the North Central West Virginia market area. He is a past president of the West Virginia Chapter of the Appraisal Institute, 2005 and 2006. He is a graduate of Fairmont State University with a B.S. in Business Administration. As a founding director, Mr. Warash has in-depth knowledge of MVB and its operations. In addition, Mr. Warash has expertise in the areas of real estate and appraisals.

Management and Directors:

In addition to the nominees, the following are the remaining directors and the executive officers of MVB.

| Directors | Age as of April 1, 2013 | Director and/or Officer Since | Term Expires | Principal Occupation During the Last Five Years | ||||

| Stephen R. Brooks | 64 | 1999 | 2014 | Attorney – Flaherty Sensabaugh & Bonasso PLLC | ||||

| Joseph P. Cincinnati | 48 | 2009 | 2015 | Orthopedic Surgeon | ||||

| Berniece D. Collis | 58 | 2008 | 2014 | Vice President – Minghini’s General Contractors, Inc. | ||||

| Larry F. Mazza * | 52 | 2005 | 2014 | January 1, 2009, President & CEO – MVB and Bank; previously Chief Executive Officer-MVB Harrison, Inc.; Director –MVB and Bank | ||||

| Dr. Saad Mossallati | 64 | 1999 | 2014 | Vascular Surgeon | ||||

| Dr. Kelly R. Nelson | 53 | 2005 | 2015 | Physician | ||||

| Nitesh S. Patel | 49 | 1999 | 2014 | Business Consultant; Previously President & Chief Executive Officer-D.N. American, Inc. (software development company) | ||||

| Louis Spatafore | 56 | 1999 | 2015 | President & General Manager – Friendly Furniture Galleries, Inc. | ||||

| Executive Officers of MVB Bank, Inc. (Non-Nominees): | ||||

| David A. Jones | 50 | 2005 | Sr. Vice President; Chief Credit and Risk Officer. Previously Sr. Vice President, Chief Credit Officer | |

| Donald T. Robinson | 38 | 2011 | Chief Operating Officer; Previously Regional President – MVB; Partner with Hayden Harper; SVP and Commercial Regional Manager for Huntington National Bank | |

John T. Schirripa

| 50 | 2010 | President – MVB-Central, Inc.; Previously Community President and Sr. Vice President – Huntington National Bank | |

Eric L. Tichenor

| 45 | 1999 | Sr. Vice President and Cashier; Chief Financial Officer – MVB and Bank | |

*Mr. Mazza is also a member offixed by the Board of Directors of Petroleum Development Corporation

Directors McKinney, Nossokoff, Toothman and Trent have electedas hereinafter provided pursuant to retire fromauthority which is hereby expressly vested in the Board of Directors, accordingly no information is provided

There are no family relationships among the directors, director nominees or executive officersDirectors; and each share of MVB or the Bank.

Other than previously disclosed, no MVB Board member has been a memberClass A Common Stock, whether of the boardsame or a different series, shall be identical in all respects with the other shares of another public company duringClass A Common Stock, except as to the past five years.following relative rights and preferences, as to which there may be variations between different series:

- (ii)

- whether shares may be redeemed and, if so, the redemption price and the terms and conditions of redemption;

- (iii)

- whether shares may be converted to Common Stock and if so, the terms and conditions of conversion;

- (iv)

- the amount payable upon shares in event of voluntary and involuntary liquidation;

- (v)

- sinking fund provisions, if any, for the redemption or purchase of shares;

- (vi)

- the terms and conditions, if any, on which shares may be converted; and

- (vii)

- voting rights, if any.

The Board of Directors of MVB and the Bank met twelve times during 2012. All directors attended 75% or morecorporation shall have all of the meetingspower and authority with respect to the shares of the Board of Directors and committees thereof held of which the director is a member, except for Director Patel, who attended 71% of the meetings.

In order to meet their responsibilities, directors are expected to attend board and committee meetings as well as the annual meeting of shareholders. All directors attended the 2012 Annual Meeting of Shareholders, except for Directors Cincinnati, Nelson and Patel.

Leadership Structure of the Board

The Board Chair, Vice Chair and President/CEO are three separate people. Throughout MVB’s history, this has been the leadership model. The President/CEO is responsible for the day-to-day operations and performance of MVB. The Chair and Vice Chair are involved in management of meetings and matters of governance and corporate oversight. The Chair and Vice Chair also focus on monitoring the effectiveness of the President/CEO in implementing MVB’s corporate strategy and ensuringClass A Common Stock that the Directors receive sufficient information, on a timely basis, to provide proper risk oversight.

A Governance Committee was established by MVB in December 2009. The Governance Committee’s responsibilities are defined in its Charter. The Committee, among many things, reviews the committees of the Board and membership thereof, evaluates compliance with the Director Education Policy, evaluates the current Board areas of expertise and monitors such to determine if an adjustment of Board membership is necessary. The Governance Committee will also provide oversight on issues relating to the governance and operations of MVB.

The committee structure of MVB is such that the committees are responsible for and review the areas of greatest risk to MVB. Each is chaired by an independent director. Staff members are responsible to the Chairs of the committees for requested information necessary for proper committee functioning. The significant risk areas for a community banking organization include the evaluation of the quality of the loan portfolio, the interest rate sensitivity of the institution and the reliability of its financial statements. The related committees, the Loan Review Committee, the ALCO Committee and the Audit Committee, are described below.

The Board of MVB elected a Chief Risk Officer (CRO) whose responsibility is to evaluate the MVB enterprise risk, that being all areas of risk to MVB and serve as Chair of the Enterprise Risk Management Committee (ERM). The CRO presented an ERM Committee report to the Board twice during 2012. The ERM Committee expects to report to the full Board of Directors twice during 2013. Directors Martin, Mazza and Pallotta are members of the ERM Committee.

Committees of the Board

MVB or the Bank has a number of standing committees as described below.

Human Resources& Compensation Committee. Composed of David B. Alvarez, Stephen R. Brooks- Chair, Berniece D. Collis, Kelly R. Nelson, John B. Spadafore, Louis Spatafore and Michael F. Trent. The purpose of this Committee is to address issues related to staffing, compensation and related policy matters. This Committee also is responsible for administration of the 2003 MVB Financial Corp. Stock Incentive Plan. CEO Mazza is an ex-officio member of this Committee and makes suggestions, which the Committee evaluates and, if considered appropriate, acts on. Mr. Mazza makes no recommendations nor participates in any portion of the meetings relating to his own salary. The Committee reports the results from these meetings to the Board of Directors. The Committee met three times in 2012.

ALCO Committee. Composed of James J. Cava, James R. Martin, Larry F. Mazza, J. Christopher Pallotta- Chair, Roger J. Turner and Samuel J. Warash, as well as Executive officers David A Jones, Donald T. Robinson, John T. Schirripa and Eric L. Tichenor. The purpose of this committee is to review the performance of the investment portfolio and policies to investments, liquidity and asset and liability management. The Committee reports the results from these meetings to the Board of Directors. The Committee met four times in 2012.

Loan Review Committee. Composed of David A. Jones, Larry F. Mazza, G. Warren Mickey, Leonard W. Nossokoff, J. Christopher Pallotta, Richard L. Toothman and Samuel J. Warash- Chair. The purpose of this Committee is to evaluate the adequacy of the Allowance for Loan Losses, review loans and groups of loans for risks and evaluate policies related to the Allowance for Loan Losses as necessary. The Committee reports the results from these meetings to the Board of Directors. The Committee met four times in 2012.

Governance Committee. Composed of John W. Ebert, G. Warren Mickey, Kelly R. Nelson- Chair, Leonard W. Nossokoff and Nitesh S. Patel. Chairman Martin and CEO Mazza are ex-officio members of this Committee. The purpose of the Committee is to maintain an appropriate board and committee structure by assessing skills and background to effectively staff MVB boards and committees and developing and updating governance and ethics policies for MVB. The Committee reports the results from these meetings to the Board of Directors. The Committee met ten times in 2012.

Audit Committee. Composed of James J. Cava, Jr., John W. Ebert, Christine B. Ielapi, Kenneth F. Lowe, III, Louis Spatafore- Chair, and Michael F. Trent. The purpose is to review the results of the internal and external audits, Reports of Examination from regulatory authorities and discuss the financial statements with management and external auditors and to report such to the Board of Directors.

The Audit Committee of MVB does not include an individual who is considered to be an audit committee financial expert. This is true for the entire Board of Directors as well, because no one meets the guidelines set forth by Section 407 of the Sarbanes-Oxley Act of 2002, for an audit committee financial expert. In the small community market area of MVB, individuals meeting the required credentials under the Act are very rare. All members of the Board of Directors are successful business owners and have knowledge of the requirements to run such a successful business. The directors of MVB, including those who are members of the Audit Committee, believe that having separate internal and external audits and regulatory examinations assist in insuring proper supervision, evaluation and reporting of MVB activities.

The Audit Committee met four times in 2012. The Committee meets with representatives Conley CPA Group, PLLC, who are responsible for the internal audit function of MVB and S.R. Snodgrass, A.C., who are responsible for the annual certified audit, as well as with the members of the regulatory authorities upon completion of their examinations of the Bank or MVB. During these meetings, the active management of the Bank or MVB, including CEO Mazza and CFO Tichenor,shareholders may be asked to leave the room to provide comfort of questioners and responders.

In the opinion of MVB’s Board of Directors, none of the Board of Directors, except for Directors Martin, Mazza and Turner, has a relationship with MVB that would interfere with the exercise of independent judgment in carrying out their responsibilities as directors. None of them are or have for the past three years been employees of MVB, except for Directors Martin, Mazza and Turner and none of their immediate family members are or have for the past three years been executive officers of MVB or Bank. In the opinion of MVB and its Board of Directors, the entire Board of Directors, except for Directors Martin, Mazza and Turner are “independent directors,” as that term is defined in Rule 4200(a)(15) of the Rules of the Financial Industry Regulatory Authority. The Board of Directors of MVB has adopted a written charter for the Audit Committee, a copy of which was attached as Appendix A to the 2012 Proxy Statement as required by the Securities and Exchange Commission.

Report of the Audit Committee

The Audit Committee has reviewed and discussed the audited financial statements for the year ended December 31, 2012, with management. The Audit Committee has also discussed the audited financial statements with S.R. Snodgrass, A.C., MVB’s independent accountants, as well as the matters required to be discussed by Statement on Auditing Standards No. 61 (having to do with accounting methods used in the financial statements). The Audit Committee has received the written disclosures and the letter from S.R. Snodgrass, A.C. required by Independence Standards Board Standard No. 1 (having to do with matters that could affect the auditor’s independence) and has discussed with S.R. Snodgrass, A.C., the independent accountants’ independence. Based on this, the Audit Committee recommendeddelegate to the Board of Directors (andpursuant to the Board has approved) thatterms and provisions of Chapter 31D, Article 6, Sections 601 and 602 of the audited financial statements be included in MVB’s Annual Report on Form 10-K for the year ended December 31, 2012, filed with the Securities and Exchange Commission.

This report shall not be deemed to be incorporated by reference into any filing under the Securities ActCode of 1933,West Virginia, as amended, and shall exercise such power and authority by the adoption of a resolution or the Securities Exchange Act of 1934,resolutions as amended, unless MVB specifically incorporates this reportprescribed by reference. It will not otherwise be filed under such Acts.law.

B.Nominating Committee Dividends.. The Board of Directors has not established a formal nominating committee as the entire Board serves in this capacity. The Board of Directors of MVB does not maintain a separate nominating committee, nor does it have a nominating committee charter, because the Board of Directors is relatively small and vacancies are rare. Because the full Board of Directors serves the functionholders of the nominating committee, not all directors are independent.

The Board of Directors believes that candidates for director should have certain minimum qualifications, including:

The Board of Directors does not maintain a formal diversity policy with respectClass A Common Stock shall be entitled to the identification or selection of directors for nomination to the Board of Directors. Diversity is just one of many factors the Board of Directors considers in the identificationreceive, when and selection of director nominees. We define diversity broadly to include differences in race, gender, ethnicity, age, viewpoint, professional experience, educational background, skills and other personal attributes that can foster board heterogeneity in order to encourage and maintain board effectiveness. While diversity and variety of experiences and viewpoints represented on the board should always be considered, a director nominee should not be chosen nor excluded solely or largely because of race, color, gender, national origin or sexual orientation or identity. In selecting a director nominee, the Board of Directors focuses on skills, expertise or background that would complement the existing board, recognizing that MVB’s businesses and operations are regional in nature. Our directors are or have been residents of North Central West Virginia and of the Eastern Panhandle of West Virginia/ Northern Virginia, our primary two markets. Our directors come from diverse backgrounds including the financial, industrial, professional and retail areas and information technology.

The process of the Board of Directors for identifying and evaluating nominees is as follows: In the case of incumbent directors whose terms are set to expire, the Board of Directors considers the directors’ overall service to MVB or the Bank during their term, including such factors as the number of meetings attended, the level of participation, quality of performance and any transactions between such directors and MVB and the Bank. The Board of Directors also reviews the payment history of loans, if any, made to such directors by the Bank to ensure that the directors are not chronically delinquent and in default. The Board considers whether any transactions between the directors and the Bank have been criticized by any banking regulatory agency or the Bank’s external auditors and whether corrective action, if required, has been taken and was sufficient. The Board of Directors also confirms that such directors remain eligible to serve on the Board of Directors of a financial institution under federal and state law. For new director candidates, the Board of Directors uses its network of contacts in MVB’s market area to compile a list of potential candidates. The Board of Directors then meets to discuss each candidate and whether he or she meets the criteria set forth above. The Board of Directors then discusses each candidate’s qualifications and chooses a candidate by majority vote.

The Board of Directors will consider director candidates recommended by stockholders for nominationdeclared by the Board of Directors, out of any funds legally available therefor, preferential dividends in cash, in the amounts or at the rate per annum fixed for such series, and no more. Dividends on shares of the Class A Common Stock shall be payable as determined by the Board of Directors.

C. Dividend Restriction on Junior Stock. So long as any shares of Class A Common Stock are outstanding, the corporation shall not pay or declare any cash dividends whatsoever on the Common Stock or any other class of stock ranking junior to the Class A Common Stock unless (i) any dividends payable on the Class A Common Stock of all series shall have been paid and (ii) there shall exist no default in respect of any sinking fund or purchase fund for the redemption or purchase of shares of Class A Common Stock of any series or such default shall have been waived by the holders of at least a majority of the then issued and outstanding shares of Class A Common Stock of such series by a vote at a meeting called for such purpose or by written waiver with or without a meeting.

D. Liquidation or Dissolution. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the affairs of the corporation, then, before any distribution or payment shall be made to the holders of the Common Stock or any other class of stock of the corporation ranking junior to the Class A Common Stock in respect of dividends or distribution of assets upon liquidation, the holders of the Class A Common Stock shall be entitled to be paid in full, in the event of a voluntary or involuntary liquidation, dissolution or winding up, the respective amounts fixed for such series, plus in each case a sum equal to declared and unpaid dividends thereon to the date of payment thereof. After such payment shall have been made in full to the holders of the Class A Common Stock, the remaining assets and funds of the corporation shall be distributed among the holders of the stock of the corporation ranking junior to the Class A Common Stock in respect of dividends or distribution of assets upon liquidation according to their respective rights and preferences and in each case according to their respective shares. In the event that the assets of the corporation available for distribution to holders of Class A Common Stock shall not be sufficient to make the payment herein required to be made in full, such assets shall be distributed to the holders of the respective shares of Class A Common Stock pro rata in proportion to the amounts payable upon such share thereof.

E. Status of Shares Redeemed or Retired. Class A Common Stock redeemed or otherwise retired by the corporation shall, upon the filing of such statement as may be

required by law, assume the status of authorized but unissued Class A Common Stock and may thereafter be reissued in the same manner as other authorized but unissued Class A Common Stock.

F. Amendments. Subject to such requirements as may be prescribed by law or as may be expressly set forth in the foregoing provisions of this Article V or in any amendment to these Articles establishing and designating a series of shares of Class A Common Stock, any of the foregoing terms and provisions of this Article V may be altered, amended or repealed or the application thereof suspended or waived in any particular case and changes in any of the designations, preferences, limitations and relative rights of the Class A Common Stock may be made with the affirmative vote, at a meeting called for that purpose, or the written consent with or without a meeting, of the holders of at least a majority of the then issued and outstanding shares of Class A Stock voting at the meeting in person or by proxy.

The other provisions of Article V would remain unchanged. In the event that only one of the proposals is approved by the shareholders, then Article V would be amended to reflect only the proposal adopted.

Under the Company's current Articles of Incorporation (the "Articles"), the Company has authority to issue up to 10,000,000 shares of common stock with a $1.00 par value and 8,500 shares of preferred stock. If the shareholders adopt the proposed amendments to the Articles, the Company will be authorized to issue up to 20,000,000 shares of common stock with a $1.00 par value, up to 20,000,000 shares of Class A Common Stock, with a par value of $1.00 per share (the "Class A Shares") and up to 20,000 shares of preferred stock, par value $1,000 per share (the "Preferred Shares"). The board will be authorized to provide for the issuance of one or more series of Class A Shares or Preferred Shares and, in connection with the creation of any such series, to adopt one or more amendments to the Articles determining, in whole or in part, the express terms of any such series to the fullest extent permitted under West Virginia law. As such, the Class A Shares and the increased number of the Preferred Shares would be available for issuance without further action by the Company's shareholders, except as may be required by applicable law and as described below.

The amount and terms of any Class A Shares or Preferred Shares have not yet been determined. Shares of Class A Common Stock and Preferred Shares may have dividend, liquidation and other features senior to those associated with MVB common stock. The specific features of any Class A Common Stock or Preferred Shares would be established by the board of directors.

The authority of the board with respect to the authorized Class A Shares or Preferred Shares includes, but is not limited to, the authority to determine or fix the following with respect to the Class A Shares or Preferred Shares:

- •

- the division of the Class A Shares or Preferred Shares into series and the designation and authorized number of Class A Shares or Preferred Shares (up to the number of Preferred Shares authorized) in each series;

- •

- the dividend rate of the Class A Shares or Preferred Shares and whether dividends are to be cumulative;

- •

- whether the Class A Shares or Preferred Shares are to be redeemable, and, if so, whether redeemable for cash, property or other rights;

- •

- the liquidation rights and preferences to which the holders of Class A Shares or Preferred Shares will be entitled;

- •

- whether the Class A Shares or Preferred Shares will be subject to the operation of a sinking fund, and, if so, upon what conditions;

- •

- whether the Class A Shares or Preferred Shares will be convertible into or exchangeable for shares of any other class or of any other series of any class of stock and the terms and conditions of the conversion or exchange;

- •

- the voting rights of the Class A Shares or Preferred Shares, which may be full, limited or denied, except as otherwise required by law; provided that the

recommendationsvoting rights of any series of Class A Shares or Preferred Shares may not be greater than the voting rights of the Company's common shares; - •

- the preemptive rights, if any, to which the holders of Class A Shares or Preferred Shares will be entitled, and any limitations thereon;

- •

- whether the issuance of any additional Class A Shares or Preferred Shares, or of any Class A Shares or Preferred Shares in any series, will be subject to restrictions as to issuance, or as to the powers, preferences or rights of any of these other series; and

- •

- any other relative, participating, optional or other special rights and privileges, and qualifications, limitations or restrictions, with respect to the Class A Shares or Preferred Shares or any series thereof.

The Company issued the currently outstanding Preferred Shares to enable the Company to participate in the $30 billion Small Business Lending Fund (the "SBLF") appropriated to the United States Department of the Treasury ("Treasury") under the Small Business Jobs Act of 2010. The Company sold to Treasury $8,500,000 of senior Preferred Shares. The purpose of the SBLF was to provide capital and incentives to eligible financial institutions to increase small business lending throughout the communities they serve. Under the terms of the SBLF issuance, the Company may not, without Treasury's consent, authorize or issue Preferred Shares which are receivedsenior to the shares held by Treasury with respect to the payment of dividends or the distribution of assets in the event of liquidation, dissolution or winding up of the Company.

Except for the Preferred Shares currently issued to Treasury, the Company has no present intention or agreement to issue any Class A Shares or Preferred Shares. Currently, the purpose of increasing the authorized Preferred Shares from 8,500 to 20,000 is to have additional authorized Preferred Shares should the board of directors determine the issuance of such is appropriate and beneficial to MVB. The Company is contemplating the potential issuance of Preferred Shares or Class A Shares to institutional and/or accredited investors, but no such issuance has been agreed to, or approved by the board of directors of the Company. There are no arrangements, agreements or understandings relating to the Class A Shares or Preferred Shares at least 120 days beforethis time.

Reasons for Adoption of the next annual meetingProposed Amendment

Preferred Stock. Proposal Number One would increase the number of shareholders.shares of authorized preferred stock from 8,500 to 20,000 shares, with a par value of $1,000 per share. The board of directors of the Company believes that this change will provide the Company with greater flexibility in structuring future capital raising transactions, acquisitions and/or joint ventures, including taking advantage of financing techniques that may receive favorable treatment from regulatory agencies and credit rating agencies. The effect of being able to issue Preferred Shares without shareholder approval will enable the Company to engage in financing transactions and acquisitions which take full advantage of changing market conditions with little or no delay. The board believes that this will also help reduce costs because it will not have to seek additional shareholder approval to issue the shares unless it is required to obtain shareholder approval for the transaction under applicable law. There are no arrangements, agreements or understandings relating to the Preferred Shares at this time.

Increased Shares of Common Stock and Class A Shares; Stock Split. Proposal Number Two would cause the shares of authorized common stock, 10 million shares, par value $1.00, to become 20 million

shares, par value $1.00 per share and to authorize 20 million shares of Class A Common Stock, par value $1.00 per share. The board of directors has determined that the proposed stock split effected as a stock dividend would keep the price per share of common stock at a level which is attractive to individual investors. The board of directors of the Company believes that the increase in authorized common stock and the authorization of Class A Shares will provide the Company with greater flexibility in structuring future capital raising transactions, acquisitions and/or joint ventures, including taking advantage of financing techniques that may receive favorable treatment from regulatory agencies and credit rating agencies. The effect of being able to issue additional common stock and Class A Shares without shareholder approval will enable the Company to engage in financing transactions and acquisitions which take full advantage of changing market conditions with little or no delay. The board believes that this will also help reduce costs because it will not have to seek additional shareholder approval to issue the shares unless it is required to obtain shareholder approval for the transaction under applicable law. There are no arrangements, agreements or understandings relating to the Class A Shares at this time. Prior to the offering described below, 3,506,842 shares of common stock are issued and outstanding. In addition, MVB is in the procedures set forth below must be followedprocess of selling up to 1,562,100 shares of common stock in a private placement under Securities and Exchange Commission Rule 506(c), and MVB has issued options under its incentive stock option plan for employees and directors to purchase approximately 635,500 shares of common stock, including options approved by stockholders for submitting nominations for director to the shareholders. The Board of Directors but not subject to an option grant agreement. MVB also intends to offer up approximately 125,000 shares pursuant to a Purchase and Assumption Agreement with CFG Community Bank ("CFG") and its parent, Capital Funding Bancorp, Inc., pursuant to which, MVB will purchase certain assets and assume certain liabilities of CFG and its subsidiaries for $30 million in consideration, consisting of $26 million in cash and $4 million in shares of MVB common stock, subject to certain adjustments. Assuming all of the shares in the private placement are issued, the purchase of assets from CFG is completed, and all options are exercised, the stock split will result in the issuance of an additional 5,829,442 shares. MVB has had and continues to have discussions with various banks and other companies regarding possible acquisitions of additional subsidiaries, and the consideration for such possible acquisitions may include MVB common stock. However, at this time, there are no other arrangements, agreements or understandings relating to the additional shares of common stock.

Tax Consequences of the Stock Split

The following discussion is included for general information only. Stockholders should consult their personal tax advisors to determine the particular consequences of the stock split, including the applicability and effect of federal, state, local and foreign income and other taxes. No gain or loss will be recognized for federal income tax purposes on the receipt of additional shares of Common Stock in the stock split. A holder's basis in the shares of Common Stock held immediately prior to the stock split is allocated proportionately among the original shares and the additional shares issued as a result of the Stock Split. The holding period of the shares of Common Stock received by a holder will include the period during which the shares of Common Stock owned immediately prior to the Stock Split were held.

Potential Effects of the Proposed Amendments

The actual effect of the issuance of any shares of Class A Common Stock or Preferred Shares upon the rights of the holders of common stock cannot be stated until the board of directors determines the specific rights of any shares of the Class A Common Stock or Preferred Shares. However, the effects might include, among other things, restricting dividends on common stock, diluting the voting power of the common stock, reducing the market price of the common stock or impairing the liquidation rights of the common stock without further action by the shareholders. Holders of the Company's common stock will not have preemptive rights with respect to the Class A Common Stock or Preferred Shares.

In deciding whether to issue shares of Class A Common Stock or Preferred Shares, the board of directors will consider the terms of such stock and the effect of the issuance on the operating results of the Company and its existing shareholders. The board of directors may issue Class A Common Stock or Preferred Shares for capital raising transactions, acquisitions, joint ventures or other corporate purposes that has the effect of making an acquisition of the Company more difficult or costly, as could also be the case if the board were to issue additional common stock for such purposes. The board of directors will, in the exercise of their fiduciary duties to the shareholders, weigh all factors carefully, together with the needs and prospects of the Company, before committing to the issuance of further shares not requiring shareholder approval. The board of directors does not propose this amendment for the purpose of discouraging mergers or changes in control of the Company.

Potential Anti-Takeover Effect of the Amendment

The proposed amendment to the Articles could have certain anti-takeover effects with respect to the Company. Specifically, the additional shares of Class A Shares or Preferred Shares could be issued so as to make it more difficult for a third party to acquire a majority of the Company's outstanding voting stock or otherwise effect a change of control in the Company.

Subject to the exercise of its fiduciary duties to the Company and its shareholders, the board will not issue any additional shares for any defensive or anti-takeover purpose or with features intended specifically to make any attempted acquisition of the Company more difficult.

Antitakeover Provisions

MVB's Articles and Bylaws currently contain the following antitakeover provisions:

– Staggered Directors' Terms. The directors of MVB are elected for staggered terms of three years with approximately one-third of the directors being elected in any one year. This provision has the effect of making it more difficult and time consuming for a shareholder who has acquired or controls a majority of MVB's outstanding common stock to gain immediate control of the board of directors or otherwise disrupt MVB's management.

– Advance Notice for Director Candidates. MVB's Bylaws require that shareholders who intend to alter the manner in which it evaluatesnominate candidates regardless of whether or not the candidate was recommended or nominated by a shareholder.

MVB’s Bylaws provide that nominations for election to the Boardboard of Directorsdirectors must be made by a shareholder in writing delivered or mailed to the presidentgive written notice at least 14 but not less than 14 days nor more than 50, days prior to the date of any shareholders' meeting called for the electionpurpose of directors; provided, however, that if less than 21 days’electing directors. The advance notice requirements in MVB's Bylaws afford the board of directors the opportunity to consider the qualifications of the meeting is given to shareholders, the nominations must be mailed or delivered to the president not later than the close of business on the seventh day following the day on which the notice of meeting was mailed. The notice of nomination must contain the following information,proposed nominees and, to the extent known:necessary, to inform the shareholders about these qualifications.

Nominations not made in accordance with these requirements may be disregarded by the chairman – 75% Vote Required to Remove Directors. MVB's Articles provide that holders of at least 75% of the meetingvoting power of shares entitled to vote generally in the election of directors may remove a director. This provision in MVB's Articles makes it more difficult for a third party to fill vacancies created by removal with its own nominees.

– MVB's Articles Contain Supermajority Provisions. The supermajority provisions in MVB's Articles and in such caseBylaws provide that the votes cast for each such nominee will likewise be disregarded. All nominees for electionaffirmative vote of the holders of at least 75% of the meeting are incumbent directors or directorsoutstanding shares of the voting stock of MVB subsidiarieswill be required to amend or repeal provisions in the Articles dealing with the classification of the board of directors, director nominations, appointment to newly created directorships, vacancies of directors, removal of directors and business combinations by unsolicited and unapproved third parties. The purpose of a supermajority requirement is to prevent a shareholder with a majority of MVB's voting power from avoiding the requirements of the foregoing by simply repealing them.

– Advance Notice Requirements for Shareholders Proposals. MVB's Bylaws require that a shareholder wishing to bring business before an annual meeting of shareholders must give 120 days' advance notice to MVB before the date of the board's proxy statement released to shareholders. This advance notice requirement gives the board the opportunity to consider the shareholder's proposal and to inform the other shareholders about the proposal and the board's position regarding it. This provision could discourage a shareholder from bringing a matter before an annual meeting.

– Fair Price Provision. MVB's Articles contain what is known as a "fair price provision." The fair price provision requires the approval of at least 75% of MVB's shares entitled to vote to approve transactions with an interested shareholder except in cases where either (1) price criteria and procedural requirements are included as nominees in this Proxy Statement. No shareholder recommendationssatisfied, or nominations have been made.(2) a majority of MVB's board of directors recommends the transaction to the shareholders. If the minimum price criteria and procedural requirements are met or the requisite approval of MVB's disinterested directors are given, the normal requirements of West Virginia law would apply.

Executive Compensation

The following informationAn "interested shareholder" is prepared based on positions as of December 31, 2012. All compensation is paid by Bank. The following table summarizes compensation paid to executive officers andany person, other highly paid individuals for the periods indicated.

SUMMARY COMPENSATION TABLE

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Option Awards ($) | Change in actuarial present value | All Other Compensation ($) (1) | Total ($) | |||

| Larry F. Mazza | 2012 | $285.000 | None | $43,000 | $81,306 | $23,397 | $432,703 | |||

| President & CEO | 2011 | $240,000 | $ 731 | None | $68,761 | $18,713 | $328,205 | |||

| Roger J. Turner | 2012 | $220,000 | None | $12,900 | $98,058 | $14,659 | $345,617 | |||

| President – MVBFC | 2011 | $215,000 | $ 731 | None | $92,385 | $18,713 | $319,903 | |||

| Donald T. Robinson | 2012 | $185,000 | None | $37,800 | $20,516 | $ 4,768 | $248,084 | |||

| Chief Operating Officer | *2011 | $127,931 | $ 431 | - | - | $ 569 | $128,931 | |||

| Sandra D. Kokoska | 2012 | $320,193 | None | $12,450 | $63,840 | $ 3,975 | $400,458 | |||

| SVP – Mortgage Sales Mgr | 2011 | 264,413 | $12,935 | None | None | $ 5,194 | $282,541 | |||

* Mr. Robinson was hired August 11, 2011; disclosure was not required in 2011.

(1)This includes director fees of $15,450 and $6,900 for Messrs. Mazza and Turner respectively for 2012 and $12,000 and $4,500, respectively for 2011.

Except for thethan MVB Bank, Inc. Annual Performance Compensation Plan, which applies to all employees, MVB does not provide Stock Awards, Non-Equity Incentive Plan Compensation or Non-Qualified Deferred Compensation Earnings to its officers or directors.

The Board of Directors of MVB believes that the successful implementationany of its subsidiaries, who is, or who was within the two-year period immediately before the announcement of a proposed business strategy will depend upon attracting, retaining and motivating able executives, managers and other key employees. The 2003 MVB Financial Corp. Stock Incentive Plan provides thatcombination, the Human Resources & Compensation Committee appointed by the Boardbeneficial owner of Directorsmore than 10% of MVB have the flexibility to grant stock options, merit awards, and rights to acquire stock through purchase under a stock purchase program. During 2011, the Human Resources & Compensation Committee granted eight awards totaling 10,500 at an exercise price of $22.50 per share. The expense to be recognized with the awards will be amortized over five years, beginning in 2012. During 2012, the Human Resources & Compensation Committee granted eleven awards, totaling 79,500 shares at exercise prices of $22.00 and $24.00 per share. The expense to be recognized with the awards will be amortized over five years, beginning in 2013.

The following tables summarize the outstanding equity awards at fiscal year-end, December 31, 2012.

| Outstanding Equity Awards of Fiscal Year-End | |||||

| Option Awards | |||||

Name

| Number of (#) | Number of Securities

| Equity Incentive Plan

| Option Exercise ($)

| Option Expiration

|

| Larry F. Mazza | 49,500 | None | None | $14.55 | 10-01-15 |

| 13,200 | 19,800 | None | $18.18 | 01-01-20 | |

| None | 25,000 | None | $24.00 | 12-31-22 | |

| Roger J. Turner | 22,000 | None | None | $14.55 | 10-01-15 |

| 8,800 | 13,200 | None | $18.18 | 01-01-20 | |

| None | 7,500 | None | $24.00 | 12-31-22 | |

| Donald T. Robinson | None | 10,000 | None | $22.00 | 01-01-22 |

| None | 7,500 | None | $24.00 | 12-31-22 | |

| Sandra D. Kokoska | None | 5,000 | None | $22.00 | 01-01-22 |

MVB does not provide Stock Award Plans for employees.

MVB provides a defined benefit retirement plan for all qualifying employees. They must have completed one year of service and be older than 21 years of age. There is a five-year requirement for full vesting. The plan provides for benefits based on the highest five consecutive years of earnings; times 2%; times years of service. Normal retirement age is 65. All retiree benefits are calculated in the same manner.

Employment Agreements and Change in Control

MVB and the Bank have employment contracts with Messers Mazza, Turner, Robinson and Ms. Kokoska. The general terms of these contracts are described below:

Under the terms of the contract with Mr. Mazza, effective January 1, 2010, he serves as Chief Executive Officer of MVB and the Bank. The term of Mr. Mazza’s contract is for one year. The agreement automatically renews for an additional one year on January 1 of each year unless written notice of non-renewal of the agreement is provided no later than December 1 of each year. The base salary is $285,000, effective January 1, 2012 and is subject to adjustment annually by the Board of Directors. If terminated without cause, Mr. Mazza shall receive an amount equal to that payable under the Agreement over a period of twelve months and such benefits as provided at the time of termination. If terminated as a result of the legal disability, Mr. Mazza shall be entitled to receive benefits under MVB’s long-term disability policy. Mr. Mazza, for the remaining term of the agreement, shall be entitled to receive an amount equal to the remaining term of the agreement less the long-term disability benefits. If terminated under a change in control of MVB or the Bank, Mr. Mazza would be entitled to receive compensation equal to that payable under the Agreement for a period of 12 months.

Mr. Turner’s contract is for a one-year term, effective January 1, 2010. The agreement automatically renews for an additional year on January 1 of each year, unless written notice of non-renewal of the agreement is provided no later than December 1 of each year. If at the end ofMVB's voting power. It also includes any contract year, Mr. Turner wishes to extend his employment on a part-time basis, the contract provides the basis for such part-time work. The base salary is $220,000, effective January 1, 2012 and is subject to adjustment annually by the Board of Directors. If terminated without cause, Mr. Turner shall receive an amount equal to that payable under the agreement over a period of twelve months and such benefits as provided at the time of termination. If terminated as a result of the legal disability, Mr. Turner shall be entitled to receive benefits under MVB’s long-term disability policy. Turner, for the remaining term of the agreement, shall be entitled to receive an amount equal to the remaining term of the agreement less the long-term disability benefits. If terminated under a change in control of MVB or the Bank, Mr. Turner would be entitled to receive compensation equal to that payable under the Agreement for a period of twelve months.

Mr. Robinson’s contract is for a one-year term, effective April 18, 2011. The agreement automatically renews for an additional year on the anniversary date of each year for an additional one year. For the purposes of determining the anniversary date of this Agreement December 31 of each year will be used. Written notification of non-renewal must be provided no later than December 1 of each year. The base salary is $185,000, effective January 1, 2012 and is subject to adjustment annually by the Board of Directors. If terminated without cause, Mr. Robinson shall receive an amount equal to that payable under the agreement over a period of twelve months and such benefits as provided at the time of termination. If terminated as a result of the legal disability, Mr. Robinson shall be entitled to receive benefits under MVB’s long-term disability policy. Robinson, for the remaining term of the agreement, shall be entitled to receive an amount equal to the remaining term of the agreement less the long-term disability benefits. If terminated under a change in control of MVB or the Bank, Mr. Robinson would be entitled to receive compensation equal to that payable under the Agreement for a period of twelve months.

Mrs. Kokoska’s contract is for a one-year term, effective April 18, 2011. The agreement automatically renews for an additional year on the anniversary date of each year for an additional one year. For the purposes of determining the anniversary date of this Agreement December 31 of each year will be used. Written notification of non-renewal must be provided no later than December 1 of each year. The salary for 2012 was $320,193 ($50,000 + commission for 2012) and is subject to adjustment annually by the Board of Directors. If terminated without cause, Mrs. Kokoska shall receive an amount equal to that payable under the agreement over a period of twelve months and such benefits as provided at the time of termination. If terminated as a result of the legal disability, Mrs. Kokoska shall be entitled to receive benefits under MVB’s long-term disability policy. Kokoska, for the remaining term of the agreement, shall be entitled to receive an amount equal to the remaining term of the agreement less the long-term disability benefits. If terminated under a change in control of MVB or the Bank, Mrs. Kokoska would be entitled to receive compensation equal to that payable under the Agreement for a period of twelve months.

The foregoing descriptions apply to agreements entered into by MVB with the Executive Officers named in the Summary Compensation Table above, or “Named Executive Officers.” In addition to these employment agreements, MVB and the Bank have entered into a number of employment agreements with other employees. One of these employment agreementsperson who is an agreement dated asassignee of, December 20, 2012, with H. Edward Dean, III. Mr. Dean became employed as President and Chief Executive Officeror has succeeded to, any shares of Potomac Mortgage Group, LLC (“PMG”),voting stock in a mortgage company acquiredtransaction not involving a public offering which were at any time within the prior two-year period beneficially owned by MVB in Decemberinterested shareholders. A "disinterested director" is any member of 2012. This agreement provides that Mr. Dean will serve as president and chief executive officer of PMG and will be nominated to serve on the board of directors of MVB who is not affiliated with an interested shareholder and who was a director of MVB prior to the time the interested shareholder became an interested shareholder. It also includes any successor to a disinterested director who is not affiliated with an interested shareholder and who was recommended by a majority of the disinterested directors then on the board.

Advantages of MVB's Anti-Takeover Provisions

The provisions discussed above may constitute defensive measures because they may discourage or deter a third party from attempting to acquire control of MVB. The agreement haspurpose of these provisions is to discourage and to insulate the corporation against hostile takeover efforts which MVB's board of directors might determine are not in the best interests of MVB and its shareholders. We believe that these provisions are reasonable precautions to ensure that a primary termparty seeking control will discuss its proposal with management.

Disadvantages of fiveMVB's Anti-Takeover Provisions

The classification of the board of directors makes it more difficult to change directors because they are elected for terms of three years rather than one year, and at least two annual meetings instead of one are required to change a majority of the board of directors. Furthermore, because of the smaller number of directors to be elected at each annual meeting, holders of a minority of the voting stock may be in a less favorable position to elect directors through the use of cumulative voting. The supermajority provisions make it more difficult for shareholders to effect changes in the classification of directors.

The ability of the board of directors to issue additional shares of common, Class A Common Stock and Preferred Shares also permits the board of directors to authorize issuance of the stock which may be extended by Mr. Dean,dilutive and, in the case of Class A Common Stock or Preferred Shares, which may affect the substantive rights of shareholders without requiring an additional shareholder vote.

Collectively, the provisions may be beneficial to management in a hostile takeover attempt, making it more difficult to effect changes, and at his option, for successive termsthe same time, adversely affecting shareholders who might wish to participate in a takeover attempt.

Recommendation and Vote

The affirmative vote of up to three years. Mr. Dean’s base compensation under the agreement is $500,000 per year, plus an earnout for a pre-tax income (excluding certain administrative expenses and other specific adjustments). Subject to certain exceptions, for eachmajority of the three fiscal yearsshares of common stock present at the meeting is required to adopt the proposed amendment to Article V of the initial termArticles. MVB is in the process of determining whether the United States Treasury is entitled to vote on Proposal 1. If the Treasury is entitled to vote on Proposal 1 and votes against the proposal, then Proposal 1 will not be adopted. Common stock represented by properly executed and returned proxy cards will be voted as specified or, if no instructions are given (except in the case of broker non-votes), will be voted "FOR" the adoption of the agreement, Mr. Dean is eligibleproposed amendments to receive 74% of 50% of PMG’s annual pre-tax income over $8 million, until the total PMG pre-tax income reaches $24,000,000. After the $24,000,000 in PMG earnings is reached, Mr. Dean will be entitled to receive 74% of 25% of PMG’s pre-tax income, subject to certain exceptions, for the remainderArticle V of the initial term. The agreement also provides for commissions payable to Mr. Dean for eligible loans over the term of the agreement which are originated by Mr. Dean. Generally, the commission is .80% per loan, except for construction loans and home equity lines of credit, for which the commission is .50%, subject to decreases to ensure a minimum return on home equity lines of credit. The agreement also provides for the issuance of options to purchase 5,000 shares, with vesting of 1,000 shares on each of the five anniversary dates after December 20, 2012. The agreement also provides for a monthly vehicle allowance of $1,500 and participation in employee benefit plans and executive compensation programs. If Mr. Dean’s employment is terminated without cause, or terminated by Mr. Dean for a good reason, as defined under the agreement (including after a change of control) Mr. Dean would be entitled to receive 18 month’s compensation, based on the average of the previous two years. In addition, all restrictions on company stock owned by Mr. Dean would be removed, and all stock options would immediately vest. MVB and the Bank would also provide payments for health insurance premiums for the maximum time provided for under the federal Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, plus six months. These benefit payments will be in effect, regardless of the reasons for termination of employment. In addition, Mr. Dean or his family would be entitled to other employee benefits through the remaining term of the agreement. All commissions which were earned as of the date of termination would be paid in no later than 30 days after the closing of the applicable loan. If the agreement is terminated as a result of legal disability, Mr. Dean would be entitled to receive benefits under MVB’s long-term disability policy. The agreement also provides that, on termination without cause, or termination by Mr. Dean without good reason, as defined in the agreement, Mr. Dean will not compete with, or solicit customers or employees of MVB or PMG for a period of 18 months. Pursuant to the agreement, on December 31, 2012, MVB entered into an indemnification agreement with Mr. Dean, which provides for indemnification and advances in expenses and costs incurred by Mr. Dean in connection with claims, suits or proceedings arising as a result of his service with the Company, to the fullest extent permitted by law.

Director CompensationArticles.

No compensation is paid for serving as a memberThe board of the Board of MVB. Members of the Board of Directors of the Bank receive a fee of $300 for each Board meeting attended and a fee of $150 for each Committee meeting attended. To the extent a director fee is paid by a subsidiary, such fee is also included below. MVB-Central, Inc. and MVB-East, Inc. paid a fee of $300 per meeting attended. The table below provides detail information about non-executive director fees paid in 2012. All director compensation is paid in cash.

| Name | 2012 Director Compensation ($) | Name | 2012 Director Compensation ($) | |||||||

| Stephen R. Brooks | $14,900 | Leonard W. Nossokoff | $12,300 | |||||||

| Joseph P. Cincinnati | 10,600 | J. Christopher Pallotta | 16,300 | |||||||

| Berniece D. Collis | 15,200 | Nitesh S. Patel | 6,900 | |||||||

| Harvey M. Havlichek | 8,100 | Louis W. Spatafore | 13,800 | |||||||

| James R. Martin | 19,700 | Richard L. Toothman | 7,500 | |||||||

| Barbara A. McKinney | 6,900 | Dr. Michael F. Trent | 8,400 | |||||||

| Dr. Saad Mossallati | 8,850 | Samuel J. Warash | 9,950 | |||||||

| Dr. Kelly R. Nelson | 14,000 | |||||||||

MVB does not provide Stock Awards, Option Awards, Non-Equity Incentive Plan Compensation, Nonqualified Deferred Compensation Earnings or any other compensation to directors.

Certain Transactions with Directors, Officers and Their Associates

MVB and the Bank have, and expect to continue to have, banking and other transactions in the ordinary course of business with its directors and officers and their affiliates, including members of their families or corporations, partnerships or other organizations in which officers or directors have a controlling interest, on substantially the same terms (including documentation, price, interest rates and collateral, repayment and amortization schedules and default provisions) as those prevailing at the time for comparable transactions with unrelated parties. Allunanimously recommends that shareholders vote "FOR" approval of these transactions were made on substantially the same terms (including interest rates, collateral and repayment terms on loans) as comparable transactions with non-affiliated persons. MVB’s management believes that these transactions did not involve more than the normal business risk of collection or include any unfavorable features.

proposals.

Principal Holders of Voting Securities

As of MarchDecember 1, 2013, there arewere no shareholders that currently beneficially own or have the right to acquire shares that would result in ownership of more than 5% of MVB’sMVB's common stock.

Ownership of Securities Byby Directors Nominees and Executive Officers

As of MarchDecember 1, 2013, ownership by directors nominees and executive officers in MVB was:

| Shares of Stock Beneficially Owned(1) | Percent of Ownership | |||||||

| David B. Alvarez** | 86,778 | 2.64 | ||||||

| Stephen R. Brooks | 17,912 | .55 | ||||||

| James J. Cava, Jr.** | 41,870 | 1.28 | ||||||

| Joseph P. Cincinnati | 39,589 | 1.21 | ||||||

| Berniece Collis | 9,094 | .28 | ||||||

| H. Edward Dean** | 91,583 | 2.79 | ||||||

| John W. Ebert** | 19,410 | .59 | ||||||

| James R. Martin | 59,212 | 1.80 | ||||||

| Larry F. Mazza | 123,437 | 3.76 | ||||||

| Barbara A. McKinney* | 6,119 | .19 | ||||||

| Dr. Saad Mossallati | 146,950 | 4.48 | ||||||

| Dr. Kelly R. Nelson | 21,516 | .66 | ||||||

| Leonard W. Nossokoff* | 94,147 | 2.87 | ||||||

| J. Christopher Pallotta | 53,909 | 1.64 | ||||||

| Nitesh S. Patel | 73,134 | 2.23 | ||||||

| Louis W. Spatafore | 14,221 | .43 | ||||||

| Richard L. Toothman* | 15,053 | .46 | ||||||

| Dr. Michael F. Trent* | 20,707 | .63 | ||||||

| Roger J. Turner | 47,872 | 1.46 | ||||||

| Samuel J. Warash | 21,845 | .67 | ||||||

| David A. Jones | 23,155 | .71 | ||||||

| Donald T. Robinson | 8,428 | .26 | ||||||

| John T. Schirripa | 20,811 | .63 | ||||||

| Eric L. Tichenor | 12,657 | .39 | ||||||

| TOTAL | 1,069,409 | 32.58 | % | |||||

* Indicates director has elected to retire

** Indicates first time director nominee

| | Shares of Stock Beneficially Owned(1) | Percent of Ownership | |||||

|---|---|---|---|---|---|---|---|

David B. Alvarez | 128,775 | 3.49 | |||||

Stephen R. Brooks | 17,948 | 0.49 | |||||

James J. Cava, Jr. | 42,116 | 1.14 | |||||

Joseph P. Cincinnati | 39,916 | 1.08 | |||||

Berniece Collis(4) | 9,453 | 0.26 | |||||

H. Edward Dean, III | 92,826 | 2.52 | |||||

John W. Ebert | 19,572 | 0.53 | |||||

Gayle C. Manchin | 10,772 | 0.29 | |||||

James R. Martin(4) | 59,213 | 1.61 | |||||

Larry F. Mazza | 140,037 | 3.80 | |||||

Dr. Kelly R. Nelson | 21,516 | 0.58 | |||||